|

|

| |

| |

| CORPORATE GOVERNANCE |

| RISK MANAGEMENT |

| |

| Overview |

| An Enterprise-wide Risk Management (ERM) system, designed in line with COSO-ERM, is in place to effectively manage risk across the organisation. A Finance, Investment and Risk Management (FIRM) Council has been instituted to help the ERM team prioritise organisation-wide risks, review and steer mitigation efforts in line with our risk capacity and appetite. |

| |

| The objectives of the ERM function are as follows: |

| |

|

Proactively identify and highlight risks |

| |

|

|

Facilitate discussions around risk prioritisation

and mitigation |

| |

|

|

Provide a framework to assess risk capacity and appetite |

|

|

|

Develop warning systems for any breach of the defined risk level |

| |

|

|

Provide evidence that a formal and focussed risk

management process is facilitating a reduction in

residual risks |

|

|

| |

| |

| Four key frameworks have been devised and implemented to institutionalise risk management across Dr. Reddy's. |

| |

|

| |

| |

| |

| |

| |

| Risk Prioritisation Framework |

| The ERM team focusses on identification and prioritisation of key business, operational and strategic risks. This is carried out through structured interviews, surveys, on-call discussions and incidents. |

| Risks are identified at the unit, function and organisation level, and categorised into four risk groups – Financial, Reputation, Regulatory and Safety & Environment. |

| |

| Risk Group |

|

Criteria |

|

Impact

(Components of Risk Appetite) |

| Financial |

|

EBITDA |

|

EBITDA shortfall |

| |

|

Credit worthiness |

|

Change in financial ratios |

| |

|

Value of the enterprise |

|

Loss in the market cap |

| Reputation |

|

Public profile

|

|

Negative media attention,

opinion leader and public criticism |

| |

|

Employee confidence

|

|

Employee dissatisfaction

|

| Regulatory |

|

License conditions |

|

Loss of credibility with regulators |

| |

|

Employee and public safety

|

|

Change in availability (%)

in one year; accident severity

|

Safety &

Environment |

|

Environmental performance

|

|

Adverse environmental impact

(because of solid, liquid and gaseous

effluents)

|

|

| |

|

|

|

|

|

| |

|

| |

| |

| |

| Risk Response and Management Framework |

| For response readiness, the risks are divided into three categories |

| |

| Preventable |

| These are generally internal or controllable risks, and they should be mitigated through strict compliance and a strong corporate culture. |

|

|

| Strategic |

| These are voluntarily accepted risks to generate superior returns for stakeholders. They need to be closely monitored and managed through tools such as likelihood/impact analysis, Key Risk Indicator (KRI) scorecards and prudent resource allocation. |

|

|

| External |

| These are risks due to external factors, and are beyond the influence and control of the organisation, and need to be managed through stress testing/tail risks, scenario planning and war gaming. |

|

|

| |

|

| |

| |

| |

| Integrating Risk Management with Company Strategy |

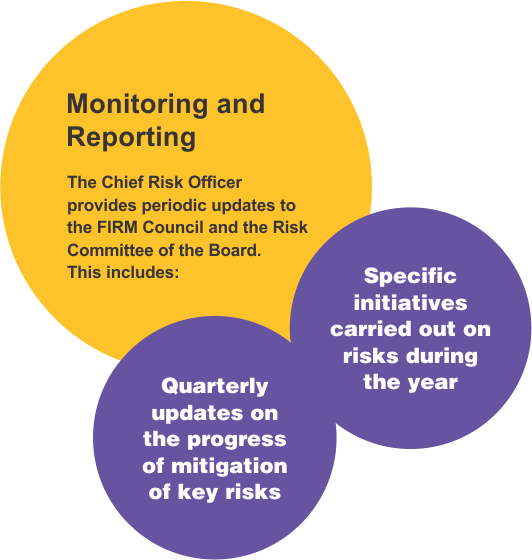

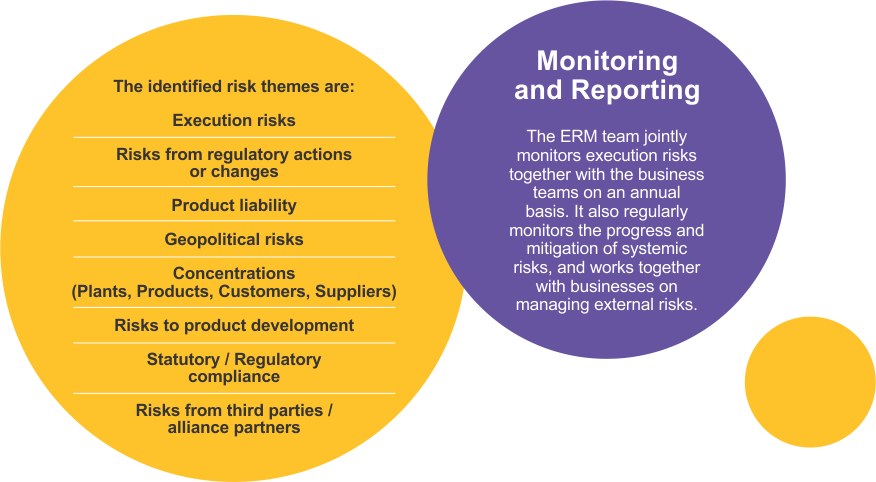

| In May 2014, the ERM team identified 8 key risk themes associated with the Company's strategy and is working to systematically identify risk aspects and mitigation, as well as embedding some of these into the Strategic Planning process. |

|

|

| |

|

| |

| |

| Risk Appetite Setting and Monitoring |

| The ERM team regularly monitors risk exposure against a pre-determined risk appetite for key risks, as part of the Governance mechanism. Any risk exposure or event that exceeds the threshold is brought to the attention of the Board or the Management Risk Committee. For financial risks, the risk appetite is linked to the Company's EBITDA and for operational risks such as safety/health & quality, it is linked to pre-determined Lag Key Risk Indicators. |

|

|

| Business Continuity Planning |

A pilot business continuity plan was initiated in FY14 to prepare the Company for unforeseen supply chain risks

and is scheduled to be completed in FY16. Key aspects of the BCP are: |

|

A formal Business Continuity Programme for key sites, products and customers |

| |

|

|

A crisis management plan for the manufacturing unit to deal with external threats and risks |

| |

|

|

A structured mechanism to manage concentration risks and customer demands on continued supply chain assurance |

|

| |

| |

|

| |

|

| |

|

|